Start taking payments

Sales M-F 9 a.m. - 8 p.m. EST

Credit Card Surcharge provides you with the opportunity to lower your payment acceptance costs, improving your bottom line.

By adding an additional percentage-based fee to a customer's credit card transactions, you no longer have to limit which credit cards you accept at your business as you will now be able to cover, or partially offset, the acceptance cost of credit card transactions.

Home services

Automotive services

Personal services

Restaurants

Retail

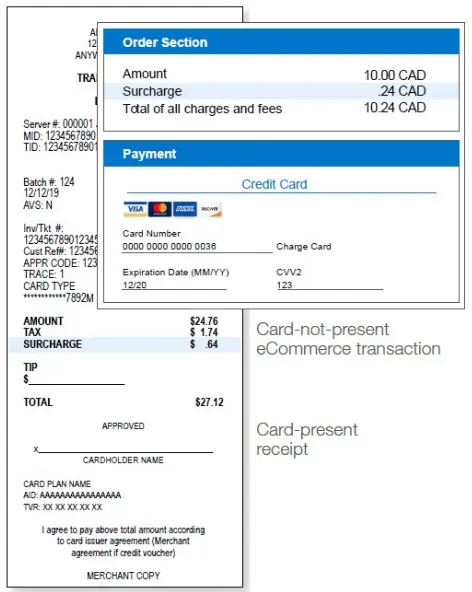

When a cardholder is making a payment with their credit card, they will be see the surcharge fee on the payment screen. The cardholder will then have the opportunity to accept the fee or change their method of payment.

If they accept the fee, the surcharge is applied to the purchase. If they do not accept the fee, they will avoid the surcharge fee by using another payment method.

The surcharge fee will not be displayed if the cardholder uses a different payment method, such as a debit card or pre-paid card.

Credit Card Surcharge is only supported on Converge

Examples with a surcharge of 2.4% (2.0% and 2.25% also available)

Open your doors to international customers with Dynamic Currency Conversion and Multi Currency Conversion. Let customers see prices and even pay in their home currencies to reduce the risk of chargebacks.

Behind the reception counter or in your office, never miss an opportunity to connect with your customers and improve in-person efficiency.

Create an easier experience for customers with a mobile POS that lets you accept payments in the aisles, at a pop-up shop or on the jobsite.